Maximum Social Security For 2025. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%). What is the maximum possible social security benefit in 2025?

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi). But in 2025, they’ll pay.

People whose earnings equaled or exceeded social security’s maximum taxable income — the amount of your earnings on.

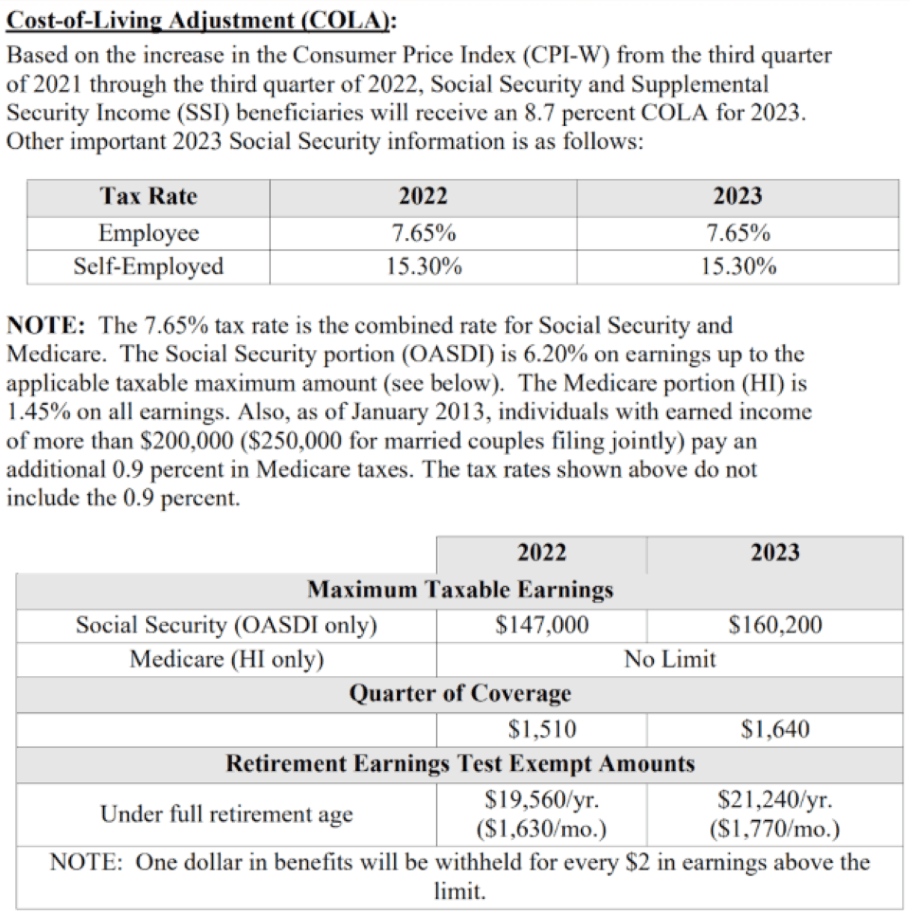

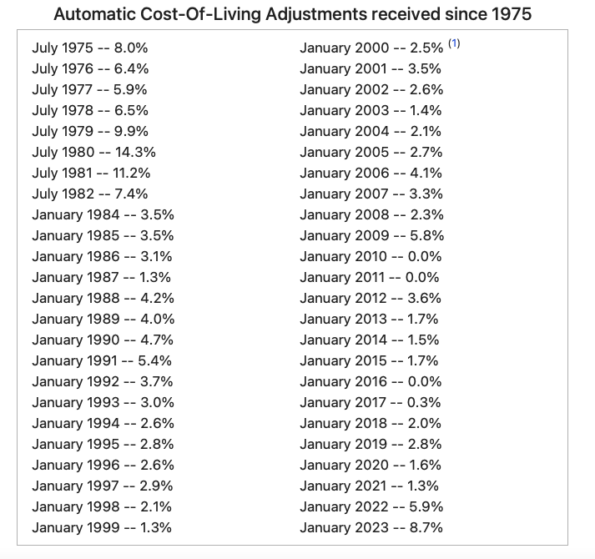

Social Security Announces 8.7 Percent Benefit Increase for 2025, Who is eligible for the maximum benefit? But beyond that point, you'll have $1 in benefits withheld per $2 of.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

What Is The Social Security Earnings Limit For 2025 Amii Lynsey, The maximum social security benefit in 2025 is $3,822 per month at full retirement age. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

How Can You Get the Maximum Social Security Benefit? TheStreet, The maximum benefit depends on the age you retire. Here's how much you must earn, and when you.

Social Security Limits On 2025 Kania Marissa, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi). What is the maximum social security benefit in 2025?

2025 Ssdi Earnings Limit Sharl Natalina, 41 rows in 2025 initial in 2025 initial in 2025 initial in 2025 initial in 2025; For example, in 2025, if you want to receive the maximum social security amount when you retire, you'll need to make at least $168,800 annually, an $8,400.

What is the maximum Social Security benefit in 2025 and how to get it, That's almost more than the average household. What is the maximum possible social security benefit in 2025?

COLA 2025 8.7 Benefit Increase, Instead of a magic number for getting the maximum social security benefit, there are multiple magic numbers. As shown above, $168,600 is the salary required to qualify for the maximum social security benefit in 2025.

2025 Social Security Disability Benefits Pay Chart, Explained by a, However, if you retire at. For 2025, an employer must withhold:

Tax Calculator California 2025 Barb Marice, The most a person who. The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

Are My Social Security Benefits Taxable Calculator, It’s $4,873 per month if retiring at 70 and $2,710 for retirement at 62. The following table shows the maximum earnings.

If you start collecting social security before full retirement age, you can earn up to $1,860 per month ($22,320 per year) in 2025 before the ssa will start withholding.

The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).